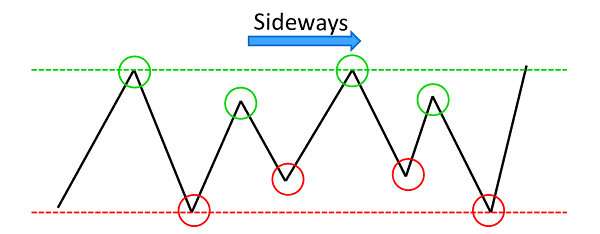

Elliot Wave Theory

Instantly Elliot Wave is a theory created by Nelson Elliot's Ralp which states that chaotic market behavior can still be predicted, the market moves in the formation of a wave that occurs repeatedly. This is because every trader almost always responds in the same way to the same event.

During trend conditions, market movements will form 5 waves and 3 corrections.

Example of a rising trend:

Wave 1: Prices start moving up, this happens because some traders feel it's time to buy, or it's time to return prices.

Wave 2: The market starts to saturate and some traders take profit taking so that the price has dropped, but it does not reach the lowest point.

Wave 3: Price moves long, because other traders begin to realize that there is a trend, so that they are riding the trend.

4th Wave: Prices are back down because some traders are taking profit taking actions because they think the price is too high and will reverse direction.

5th Wave: Prices go up again because some traders see a clear trend, so they think of following the trend, even though it's already very overbought.

elliot wave

Correction to 1: The price is reversed because it is too high and overbought.

Correction to 2: Prices go back up to find a balance to find a starting point.

Correction to 3: Price drops longer than correction to 1, this is the actual correction.

After 5 Wave and 3 Corection are formed, then the price will usually follow the direction of the trend formed by 5 waves.

The next forex learning material is about the Technical Analysis Chart Pattern

During trend conditions, market movements will form 5 waves and 3 corrections.

Example of a rising trend:

Wave 1: Prices start moving up, this happens because some traders feel it's time to buy, or it's time to return prices.

Wave 2: The market starts to saturate and some traders take profit taking so that the price has dropped, but it does not reach the lowest point.

Wave 3: Price moves long, because other traders begin to realize that there is a trend, so that they are riding the trend.

4th Wave: Prices are back down because some traders are taking profit taking actions because they think the price is too high and will reverse direction.

5th Wave: Prices go up again because some traders see a clear trend, so they think of following the trend, even though it's already very overbought.

elliot wave

Correction to 1: The price is reversed because it is too high and overbought.

Correction to 2: Prices go back up to find a balance to find a starting point.

Correction to 3: Price drops longer than correction to 1, this is the actual correction.

After 5 Wave and 3 Corection are formed, then the price will usually follow the direction of the trend formed by 5 waves.

The next forex learning material is about the Technical Analysis Chart Pattern

Komentar

Posting Komentar